The deadline for Los Angeles tenants to pay back rent accrued during much of the COVID-19 pandemic has passed, and the city is taking measures to ensure tenants stay housed…

COVID-19 state law

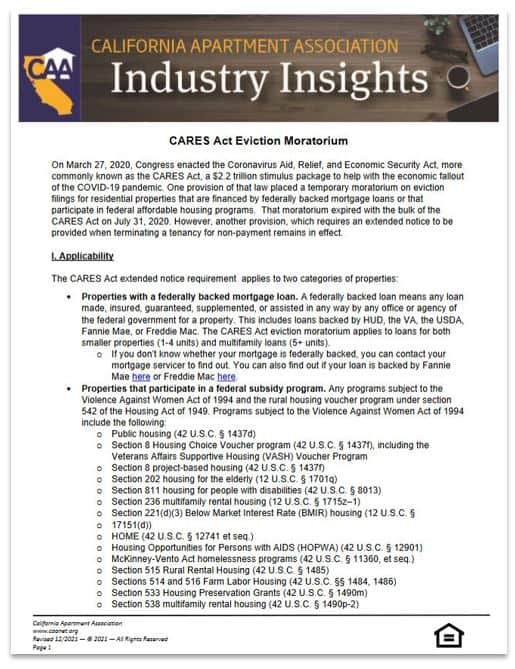

The COVID-19 Tenant Relief Act (“CTRA”) and COVID-19 Rental Housing Recovery Acts (“Recovery Act”) enacted temporary protections from eviction for residents unable to pay rent and other charges during the COVID-19 pandemic. Most, but not all of the protections in these laws have expired.

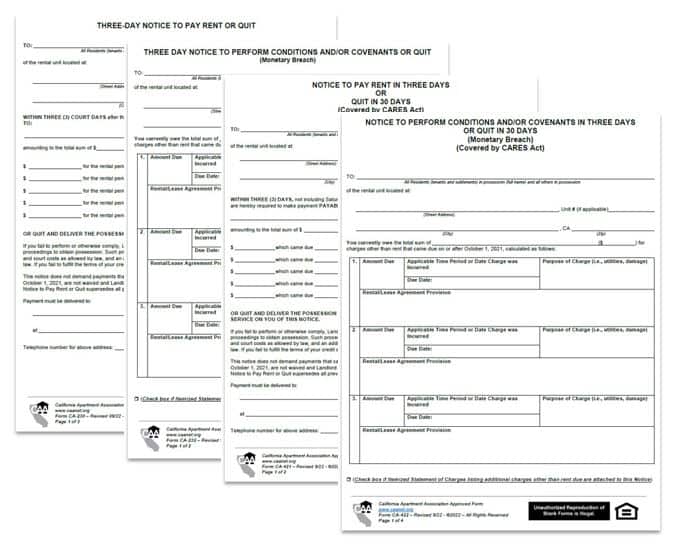

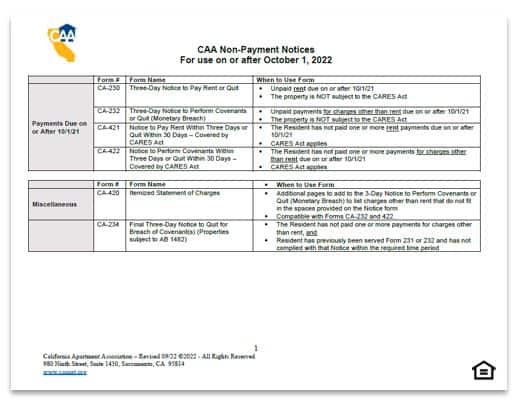

Effective July 1, 2022, standard three-day notices can be used for rent and other payments due on or after October 1, 2021. A hybrid 3/30 day notice is still required if the property is covered by the CARES Act (see below). CAA’s 15-day notices for non-payment of amount due prior to October 1, 2021 have been discontinued. See CAA Non-Payment Notices below.

For information about the current status of all tenant protections enacted by CTRA and the Recovery Act, see the Industry Insight linked below.

Compliance Materials

Local COVID-19 Tenant Protections

CAA has created summaries of the moratoria in the most populous areas. Click below for CAA Summaries on local COVID-19 Tenant Protections

Forms

In the News

Alameda County landlords are still owed significant amounts of back rent that accumulated during the COVID-19 pandemic, a survey conducted by the California Apartment Association shows. On average, the-nearly 100…

Despite nearly unanimous, bipartisan support throughout the legislative process, a CAA-sponsored bill that would have protected landlords from unjustifiable rent caps during extended states of emergency has stalled in the…

After working their way through the state Legislature for several months, two bills sponsored by the California Apartment Association now face their most significant hurdle yet: advancing from the Assembly…

California’s Judicial Council has approved two revised forms for use in eviction cases, as the bulk of COVID-19 Tenant Relief Act (CTRA) tenant protections expired as of July 1, 2022.…

After more than two years and multiple extensions, most remaining elements of California’s COVID-19 eviction moratorium have come to an end. June 30 was the last day for both the…

The California Apartment Association on July 1 will hold a webinar on the end of California’s COVID-19 eviction moratorium and what it means for rental housing providers. June 30 is…

Barring surprise action in the state Legislature, most of the final remnants of the California’s COVID-19 eviction moratorium will expire at the end of this month, although some local governments…

The state Senate has approved a pair of CAA-sponsored bills that together would help more landlords recover from the COVID-19 pandemic and clarify how California’s anti-price-gouging law applies to rental…